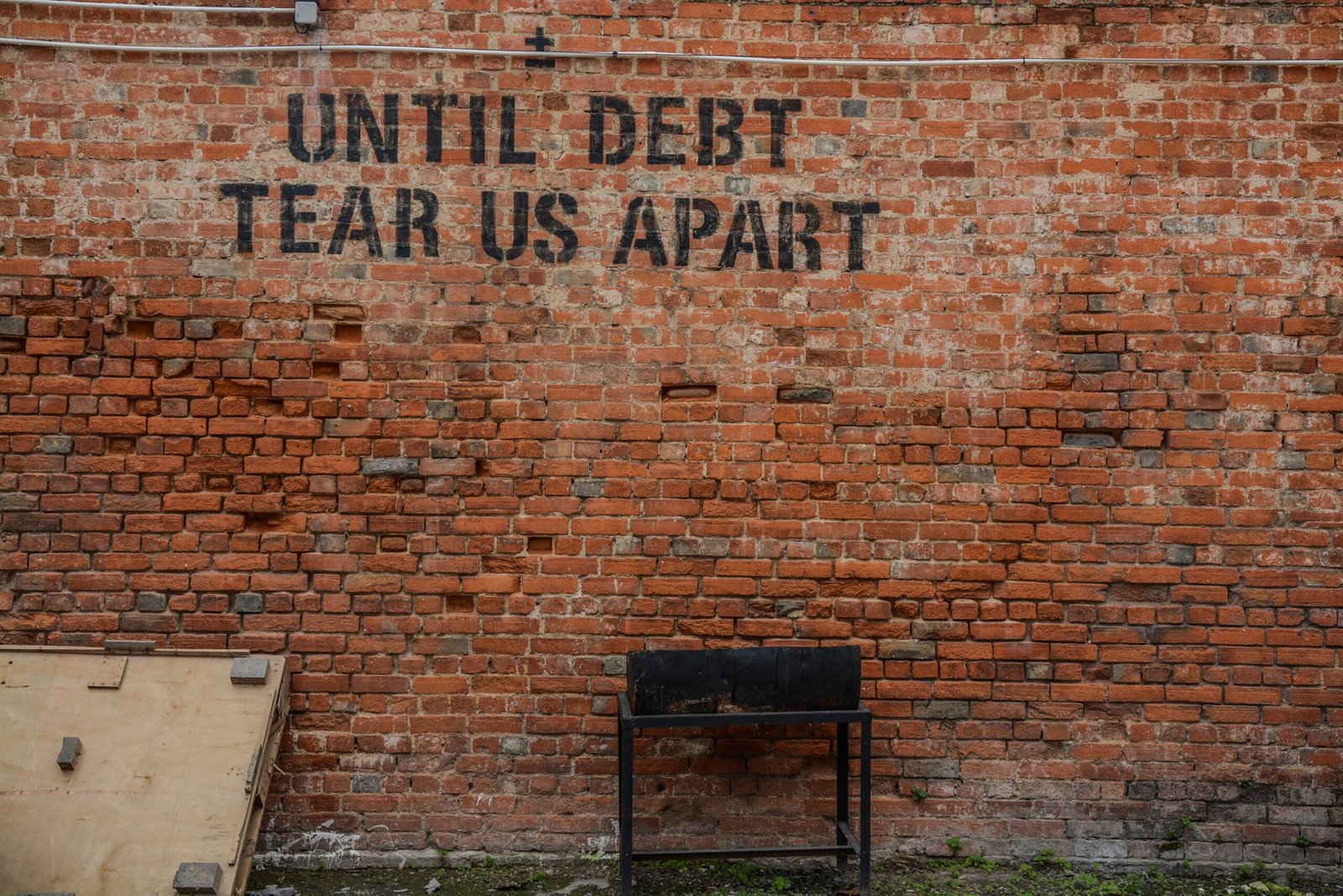

Dealing with multiple debts can be overwhelming and unbelievably stressful. Student Loans, car repayments, credit cards, fines, medical bills…the road never seems to end. The stress can cause health related issues. People around you start to notice. They avoid you because you’re just so off the map. You don’t even want to be around you. So then something comes along that seems to offer a way out. It’s like a green and blue mirage you come across in the desert. The palm trees and pure water just looks amazing. Kind of hazy in the heat. But you’ll soon be there. And you’re so thirsty! It must be your lucky day. The mirage is called Debt Consolidation.

The Benefits of Debt Consolidation

The main idea of debt consolidation is that it puts all your debts into one place. You get a loan from a financial institution (yeh, those guys) and roll all of your financial obligations into one debt only. The lender may need to use your house or your spouse as collateral. But there’s only one payment you have to make monthly. Only one interest rate. And you can plan ahead now with a budget. You might even start doing a budget!

Some debt consolidation methods involve transferring high interest rate credit cards and other debts to 0% interest rate credit cards. The 0% balance transfer rate doesn’t last forever though. Before long you’ll be paying rates as high as the sky. You can keep going with other balance transfers to low rate cards. But the debt balance always stays the same. Maybe you can just do this forever…

The Mirage of Debt Consolidation

The issue of debt consolidation is that the debt has only been moved on. It might be more visible, but it’s still there. All of the effort that was taken to roll the debt into a consolidation loan, or balance transfer it to low interest areas, could have been better spent in approaching from the front door in the first place.

There are of course examples of people who have used debt consolidation strategies to payoff their debts. And they’ve lived to tell the tale. What they’ve actually done is use debt consolidation along with financial discipline to engage in a strategy that wasn’t just about consolidating debt. They actually wanted to pay off their debt, not kick the can down the road.

The financial behaviour that got folks into debt is the primary reason they stay in debt. Even if they consolidate their loans. The underlying behaviour doesn’t change. They are just moving their debt from one place to the next. And that’s just not a good strategy if you want to get financial freedom and want get control of your life.