The middle class are almost as dead as a dodo. They’ve been dying for some time. They’re now only seen on some urban safari run by the American Dream marketing company. If you’re lucky, you might catch a glimpse of them on a bus with long lens binoculars. They used to be everywhere. Now they’re nearly extinct.

The middle class has just become the working class. They are the poor middle section of America who have largely given up being in a property owning democracy. They are weighed down by the usual rag-bag debt traps of mortgages, credit cards, and student loans. They work all the time. They have to work otherwise they and their family will end up on the kerb.

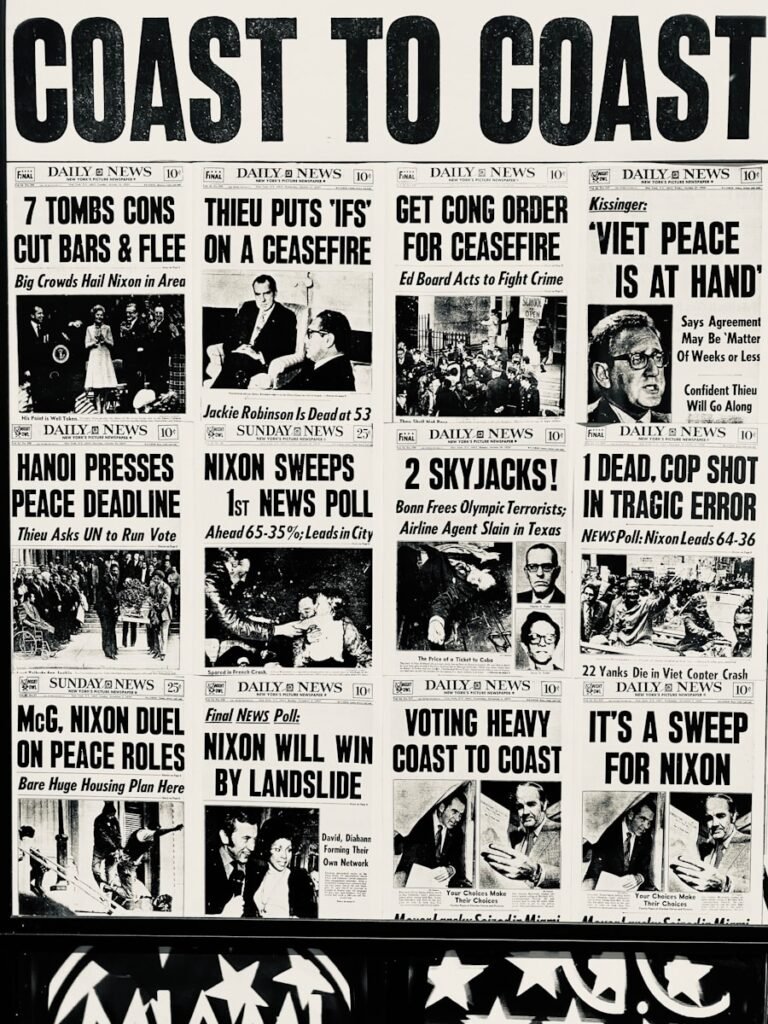

Nixon Shock

The middle class used to dream big. But the 1950’s dream of unlimited prosperity, founded on a property owing democracy, evaporated in 1971. That’s when the Nixon Shock reverberated through the suburbs knocking down plastic ducks above fireplaces. The U.S. dollar was no longer tied to gold.

The Europeans, and all overseas countries who had the cheekiness to redeem their U.S. dollars for gold, were going to get short shrift. The French back-stabber De Gaulle, in particular, was going to get stabbed back. The precious gold that they kept looting was now going to be kept stateside. To the middle-class, it even seemed a patriotic thing to do. That’s until they found out what came next.

The effect of the Nixon Shock was severe, and the opposite of what was promised. Stagflation had never been seen before, but now it was in the suburbs. The U.S. dollar become unstable. Cost of goods, led by a spike in oil prices, went crazy. Food in supermarkets skyrocketed. Money didn’t buy nearly anything like it used to. Does this sound familiar?

Fiat Means Fake

Fiat currency is money issued by decree or “fiat.” It is backed by the faith and credit of the U.S. government. Basically, it’s fake money. Before 1934, things were different. You could actually redeem your money for gold or silver. So you were actually dealing with lawful money in those days.

But Congress put a stop to that pesky lawful money. They then doubled down in 1971 by taking the U.S. dollar off the gold standard. You know, that Nixon Shock thing. Afterall, if you run a government that loves to pull fast ones over the honest middle class, why would you issue lawful money when you can just issue huge amounts of fake money?

Credit Card Convicts

So in a system of fake money, it becomes apparent where the real traps are for the working class. One of the traps are credit cards.

Credit cards are prolific for the card carrying working class. What truly marks you out as working class is carrying a membership card around with you that says Mastercard (master beats the slave), or Diners Club (because you can’t dine on anything unless you go into more debt). So if you don’t want to be working class credit card convict, perhaps don’t carry the card. Good luck with that.

The Mortgage Hospital

The property owning democracy has been replaced with the banking autocracy. Lending against houses used to be the biggest game in town for banks to make fake money. It didn’t matter that housing stock should be used to make people feel safe and secure. What matters now is having their working slave think it’s a good idea to have a 10, 20 or even 30 year mortgage.

The working slave (and I know this is truly mind-boggling) will feel happy about being a slave and having a mortgage for their entire working life. They won’t own anything else. All the money they could have invested in their future instead went into paying back the mortgage. Yes, great to have a fully paid house, but not so great if you’ve got nothing else except medical bills to pay. But that’s why it’s called the American Dream. It’s the dreaming you do when lying in bed with a saline drip in your arm at an expensive hospital you can’t afford.

The only thing the bank doesn’t like are people who buy houses for cash. Or even people who don’t buy houses at all because they avoid that trap in the first place. How can the banks make a fake dollar out of these crazy people?

Student Loan Trapdoor

The relatively newest debt trap are student loans. They have the advantage of not being tied to property. So the above category of renegade mortgage-avoidee doesn’t apply. No students who are bankrupt can actually hand back the front door keys to their student loan. Student loans might not have doors, but there’s plenty of financial and legal trapdoors.

As student loans cause so much misery, there are some people who don’t do them. They obain their education by paying as they go. Or if they can’t afford it, they don’t buy it, and learn from the internet and mentors (who even knows a real one anymore). The old middle class belief that you have to get a college education to get a job is now just something you see in marketing. That’s because college marketers deal with dreams, visions and magic. And that’s the only place the middle class exists anymore.