Dave Ramsey hates debt with a passion. He encourages his millions of Ramsey Show followers to avoid debt and live a responsible life. He has become rich using no debt.

Robert “Rich Dad” Kiyosaki’, is proud to be in $1.2 billion of debt. Not only this, Kiyosaki wants more debt and does everything he can to acquire it. It’s how he’s become rich.

So what is going on here. Who is right about debt, and who is wrong?

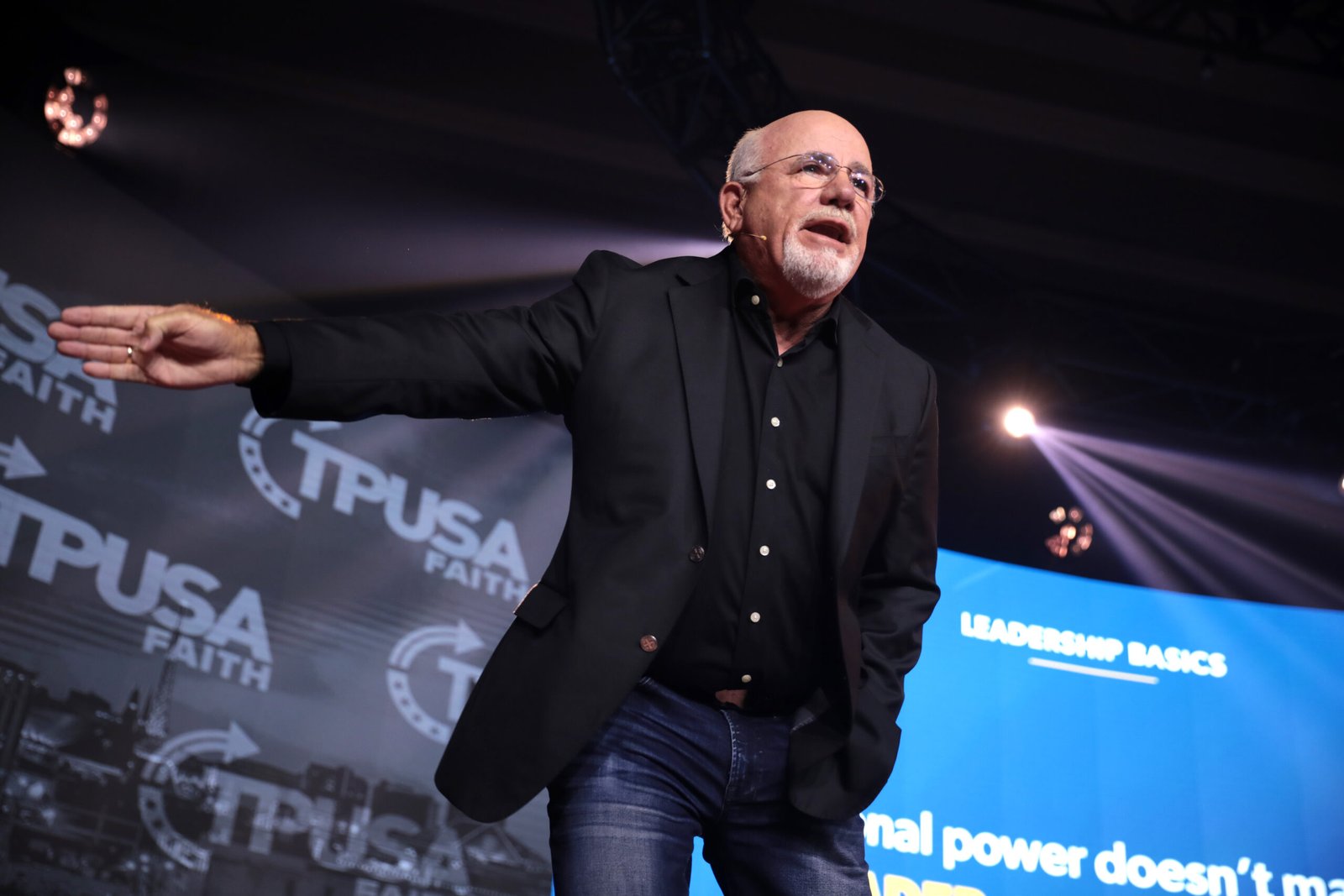

Dave Ramsey

Ramsey has spent decades on syndicated radio shows and podcasts admonishing Americans for the ridiculous debt that they carry. He has been a one man war on car shark loans, unscrupulous banks that issue credit cards, and helping folks out of the student loan crisis.

As a young man, Dave Ramsey was a successful real estate agent. He sold houses and made quick cash. With the proceeds he financed the purcase of rental houses, and owned a bunch of them. With his wife Sharon, and their new baby daughter Rachel, they had money to spend on the good things in life.

Then the bank came knocking. It was a new bank that acquired Ramsey’s “notes” from the previous bank. They didn’t care that Ramsey couldn’t pay them back straight away. They wanted the money now. Even though Dave and Sharon tried to avoid the coming disaster, they couldn’t do it. The process bankrupted them both. It made Ramsey hate debt.

Robert Kiyosaki

Kiyosaki was Marine Corps gunship pilot and is a best selling author. His Rich Dad, Poor Dad books cover topics of real estate investing, and instruction on personal finance.

In 1996, the Cashflow 101 board game came out. It was the first thing that Kiyosaki and his wife Kim Kiyosaki had developed to teach their ideas about debt and money.

Then came the original Rich Dad, Poor Dad book in 1997. Kiyosaki said that the publishers in New York couldn’t believe what they were reading. They said to Kiyosaki, you don’t know what your talking about. How can savers be losers. How can a house not be an asset. Why is a 401K a liability? Kiyosaki said on his March podcast that these ideas “violated everything these academics were tought.”

In March 2024, Kiyosaki told his Rich Dad Radio Show listeners that he is $1.2 billion debt – and loving it. Not only this, Kiyosaki said he wanted to go into more debt and that there wasn’t enough debt for him to buy.

Why Rich Dad Likes Debt

There are several reasons Kiyosaki and his wife (and his real estate advisor Ken McElroy) want to be in debt and avoid the normal things that people consider assets.

It’s his belief that only lazy people use their own money. If the deal you are organising is solid, then you will have no problem raising the finance and making the deal pay for itself.

If you have debt, you lower your taxation considerably. Only the poor middle class pay debt. The poor have no money to pay taxes, and the rich don’t pay taxes because they avoid it. Kiyosaki is one of the rich and pays as little tax as possible – legally. The way he does this is by having debt to offset his income. When he wants cash, he draws it out of his assets tax-free.

Tax-free Money

As explained by Rich Dad advisor Ken McElroy, you might have a renovated multi-unit residential block, and after renovations it brings in more income than before. Then you re-finance and pull out your investment money tax-free and still get an income. You have none of your own money left in the property, but you still get the income. The extra rent from the multi-unit pays the debt for you. This is known as an Infinite Return. It is one of the secrets of becoming rich through property.

Worry-free Life

On the other hand, Dave Ramsey has to pay for the property himself using his own money. Ramsey doesn’t get the benefit of leveraging bigger deals that his money allows. He also doesn’t get the tax benefits of having debt. He doesn’t enjoy infinite returns on any property he owns.

But he doesn’t have any bank or lender calling on him asking where his repayments are. The lender/borrower power dynamic is something Ramsey is keen on avoiding. Ramsey wants financial peace (he set up the Financial Peace University) and doesn’t want his life complicated by having lenders knocking on his door, calling him at night, or bombarding him with emails.

Ramsey has bought property by waiting for a property crash and then buying the distressed properties for pennies on the dollar. Given his patience, he’s amassed a large fully paid-for property portfolio that has increased massively in value. So he’s not had to use debt to buy property, but still ended up becoming rich anyway.

Final Thoughts

Kiyosaki and Ramsey are actually friends and have mutual respect for each other. They have been known to lunch together at Ramsey’s hometown of Nashville.

There are points on which they agree. Debt that involves consumer consumption and no creation of assets is stupid debt. Credit cards, pay day loans, car loans, and student loans, are stupid debt. They are liabilities that can make you suffer.

Even Kiyosaki agrees with his friend that poor people taking on stupid debt is crazy. For those people who are struggling with stupid debt, Dave Ramsey’s philosophy is what they should follow. They don’t have any chance of becoming rich while they’re saddled with stupid debt.

But if you are successful, have good cash-flow and capital, have the education, and band together with people who have more knowledge than you do, Robert Kiyosaki’s Rich Dad philosophy is possibly the next step.